Logistics

Industries

Technology & Innovations

E-commerce

E-commerce Fulfillment Services

Lease & Maintenance

Semi Trucks

Logistics

E-commerce

Lease & Maintenance

Buy Used Trucks

Channel cannibalization, also known as channel conflict, takes place when a company introduces a new sales or distribution channel that competes directly with an existing one, leading to a decline in overall sales for the existing channel.

Channel conflict is more likely to take place when a brand hasn't considered the impact a new channel will have on consumer behavior. If there isn't a strong unique selling point or positioning for each of your channels, they can end up competing with each other and erode overall market share.

To prevent channel cannibalization from taking place, companies need to develop a strategic approach to managing channels and ensuring that they enhance or complement each other's capabilities. This requires careful market analysis, forecasting, and planning to ensure that each channel has a unique value proposition.

The most common types of channel cannibalization that take place within retail are:

Opening an online store is a no-brainer to spread brand recognition and achieve more robust sales growth. But if traditional retailers aren't strategic about the value proposition of their e-commerce store, they could end up transferring sales from offline channels to online.

Why? Because the convenience and 24/7 nature of the online shopping journey have only increased with the growth of smartphone penetration and social commerce. When a new shirt or lipstick can be purchased online in just a few clicks, what does a physical presence offer consumers?

Stores including Macy's, Gap, and Nordstrom have struggled to answer this question. They faced falling foot traffic in the pre-pandemic years as shoppers bypassed stores in favor of their online retail channels. While online revenue surged, store losses grew exponentially, resulting in extensive store closures.

So, what did these legacy brands get wrong? Put simply, cannibalization occurs when there's no clear differentiation between online and offline channels. When it's so easy to shop online, physical stores need a strong value proposition to entice those same customers in-store. If a storefront is a carbon copy of its online counterpart, there's little incentive for shoppers to engage.

Brands that have a thriving digital presence and healthy brick and mortar sales have one thing in common; they use their storefronts as a venue for unique experiences that cannot be replicated online:

The iconic activewear and apparel retailer has built a highly loyal community not only through activity-specific product lines, but by turning store locations into pop-up yoga studios that run complimentary classes. As well as increasing foot traffic, this experiential retail strategy is a clever way to introduce both existing and new customers to yoga and relevant products that showcase their expertise in this market.

Locked in a tight battle for market share with rival Sephora and department store beauty counters, Ulta Beauty has started thinking outside the (classic storefront) box to elevate the shopping experience for in-store customers.

Their latest store redesign places new product collections, trending brands, and product demonstrations at the front of the store, moving away from arranging products and brands by price point. When it's so easy for consumers to filter products when shopping online, Ulta realized it needed to change up its store format to reflect how customers wanted to shop in a physical space, emphasizing product and brand discovery opportunities.

Like many retailers, Nordstrom initially struggled with the transition to e-commerce and how to maintain in-store sales growth while avoiding channel conflict. But they quickly hit on a winning formula that saw the legacy department store play host to some of the hottest up-and-coming brands.

Nordstrom has taken advantage of their large network and floor space to launch pop-up boutiques and in-store partnerships with the likes of Glossier, Tonal, Allbirds, and ASOS, which serves to boost foot traffic and market penetration of younger shoppers who are less likely to come in-store. This store-within-a-store strategy has kept Nordstrom relevant and on the pulse of the latest happenings in retail, while cleverly segmenting online and retail sales.

It's not uncommon for tension to exist between direct to consumer channels and wholesale partners. With pandemic restrictions rendering many store-based partnerships vulnerable to lost sales, it's not surprising that many brands saw this as an opportunity to take a bigger slice of the pie.

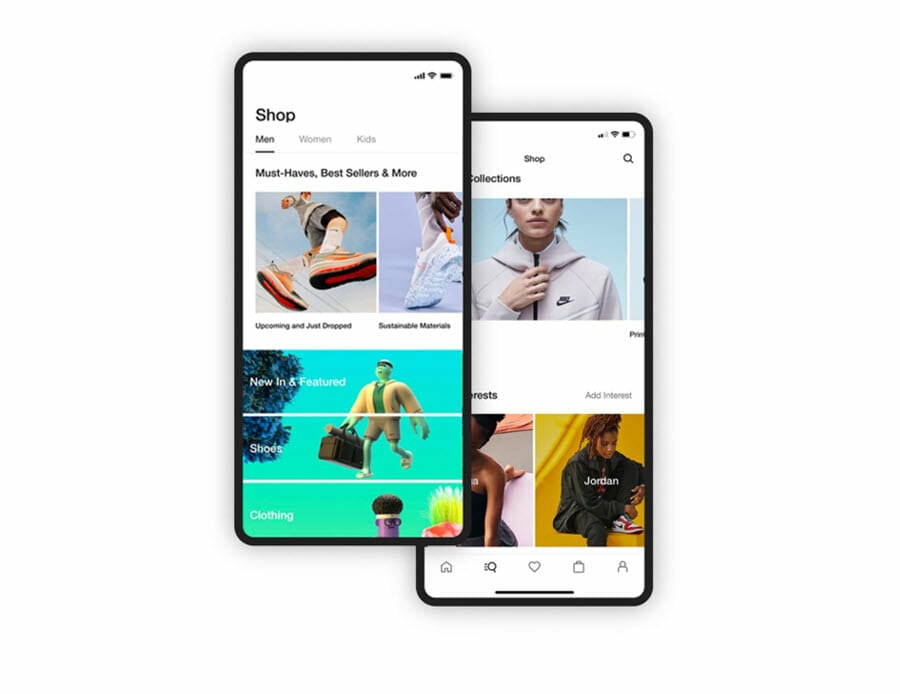

Nike chose to end its pilot partnership with Amazon in 2020 due to online sales not reaching the levels expected, instead choosing to reinvest in its D2C strategy and focus on a smaller group of priority partners.

However, wholesale partners are not outright competitors - so long as you don't treat them as such. While profit margins may be smaller, wholesale channels offer great opportunities to reach new customers and leverage the reputation of their partners. Businesses need to think holistically about wholesale and consider how they can differentiate their D2C marketing channels and product offerings from their partners.

For example, one of the biggest advantages of D2C selling is that your brand has access to first-party data that can be used to personalize the shopping journey and steer customers towards suitable products. Greater control over the supply chain and fulfillment process also enables direct to consumer brands to augment their sales channels with exclusive offerings such as subscriptions and priority access to products.

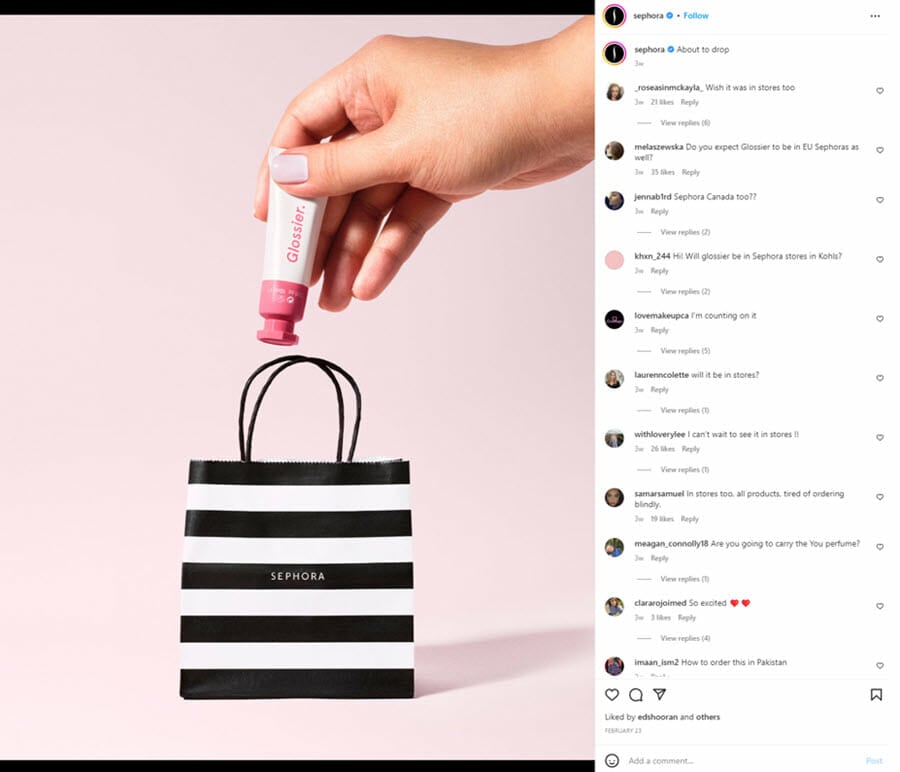

When Glossier launched in 2014 and almost instantly established a cult following, the beauty brand seemed to set a new blueprint for success. Their tiny store network and almost exclusively D2C e-commerce sales strategy was a big departure from the traditional wholesale department store approach to beauty.

Yet the Millennial beauty favorite recently hit the brakes due to growing acquisition costs and competition from other independent brands. A major pivot in strategy has seen Glossier partner with Sephora to put its products both online and within Sephora stores. This move gives Glossier fans access to Sephora's coveted Beauty Insider rewards program, helping to consolidate beauty purchases in one place.

Once a prime example of an out-of-control channel cannibalization rate, Macy's has corrected course by exploring how select wholesale partners add value to both the in-store and online shopping experiences. They recently embarked on an enhanced partnership with activewear brand Reebok by bringing more product lines into select stores - including exclusive items and capsule selections that cannot be bought from any other retailer. This unique wholesale partnership enables Rebook to avoid channel cannibalization by building out exclusive offerings, rather than one-size-fits-all channels.

The growth of e-commerce has gone hand-in-hand with the rise of a specific segment of online shopping; mobile commerce. As smartphone penetration has increased globally, more customers are preferring to purchase online via their device, rather than desktop. According to Shopping Pulse, 48% of surveyed U.S. consumers prefer shopping on mobile phones, compared to computers (41%) and tablets (11%)

This has led to an interesting puzzle for e-commerce brands. After putting in so much effort to create a seamless shopping experience on desktop, is launching a separate mobile shopping app simply going to take traffic away and cannibalize sales?

This question really hinges on the quality of the mobile e-commerce experience. A common pain point cited by consumers is that the mobile version of e-commerce sites just isn't up to par with desktop. Google found that 96% of consumers have encountered sites that weren't designed with a mobile-first approach.

Even with a responsive site design, some features of desktop e-commerce, such as checkout and search tools, don't always convert well to mobile. If this is the case, it's more likely that shoppers will abandon the journey altogether, rather than switch to a different channel.

In sum, poor mobile e-commerce experiences are more likely to cost you in overall sales, whereas a well-designed shopping app provides mobile-first consumers with the right channel for their needs. For example, folding in your shopping app with loyalty account management gives your shopping app a distinct point of difference from your e-commerce website.

Nike's shopping app is far more a mobile version of its online store. It acts as the nexus of their marketing strategy and brand ecosystem to drive customers to the appropriate shopping channel, from in-store events to exclusive online offers or the latest story on their blog. These discovery opportunities have made their app a must-have download for Nike fans. For the brand, this helps to avoid channel conflict and ensure that their target audience can find what they're looking for quickly and easily.

Unlike a simple multichannel retail strategy, an omnichannel approach to selling ensures that consumers experience a unified, cohesive journey across channels. Rather than selling channels working against each other in a zero-sum environment, omnichannel retailing accounts for the strengths and weaknesses of each channel, avoiding cannibalization and boosting overall sales.

How? Through what commentators call the 'halo effect'. When executed properly, marketing activities in one channel help to increase brand awareness and traffic to other channels, bringing shoppers deeper into your brand ecosystem and increasing market share. According to the ICSC, when customers shop online and make purchases in-store, spending increases by an average of 131%.

By leveraging each channel's unique capabilities in an omnichannel environment, brands can ensure they stay customer-centered and offer consumers the flexibility they demand. Sought-after omnichannel capabilities like Buy Online, Pick-Up In-Store (BOPIS) and in-store returns are only possible when shoppers have the freedom to move between channels and leverage the benefits of each.

For example, an in-store return or Buy Online, Pick-Up In-Store (BOPIS) order provides a clear pathway to customers into physical stores, where further sales activity can take place. Access to real-time inventory visibility can bring someone from a store location without the right merchandise to an app where they can place an online order in a few seconds. The takeaway? A clear value proposition for each channel and a unified sales strategy keeps channel cannibalization at bay, while boosting total sales and strengthening brand loyalty.