Logistics

Industries

Technology & Innovations

E-commerce

E-commerce Fulfillment Services

Lease & Maintenance

Semi Trucks

Logistics

E-commerce

Lease & Maintenance

Buy Used Trucks

As the direct-to-consumer (D2C) retail space grows, the competition is heating up. According to Statista, D2C ecommerce sales are set to hit nearly $175 billion by 2023 - and more brands are fighting for a slice of the pie.

In 2021, even the most iconic names are fighting to avoid being eclipsed in a rapidly growing market. Because in D2C retail, the ‘next big thing’ is always right around the corner.

This means that D2C growth is no longer solely taking place online. As ecommerce grows more saturated, brands are embarking on new initiatives to stay relevant - and this means the involvement of other parties.

Once the mavericks of retail who celebrated cutting out the middlemen, the D2Cs have been doing something of a 180 over the past year. Instead of complete vertical integration, more and more brands have begun joining forces with outside vendors.

Whether it’s partnerships with major retailers, such as underwear brand Proof pairing up with Target, or outright acquisitions like Wolverine World Wide bringing Sweaty Betty into its leisure portfolio, the D2C landscape is changing fast. Once dominated by hundreds of small, independent brands, we’re now seeing a bigger consolidation of D2C products under existing umbrellas or becoming shelf offerings within popular storefronts.

Having been evangelized for years was heralding a new age of retail, this evolution of the D2C market has some commentators scratching their heads. D2C verticals have prided themselves on their independence and ability to reach consumers directly, so it may seem odd to watch brands slide in the opposite direction.

Is this the end of D2Cs being marketplace disruptors? Or are we seeing the next phase of D2C influence on the retail sector at large?

As discussed in our post D2Cs are going offline: What gives?, we outlined how increased competition online is driving many digitally native brands into new channels to diversify their operation. And with legacy brands from Nike to Coca-Cola choosing to cut ties with key partners in favor of selling directly, the message to native D2Cs is clear: They need to start beating retailers at their own game.

D2C brands can realize a lot of benefits by partnering or being acquired by a major retailer - but there’s also a lot of pitfalls too. Choosing to involve other parties in your operation means giving up the level of control you’re used to, but also frees up more time to focus on product innovation and community building.

So, what do brands need to consider when making the transition from D2C to a hybrid retail model?

The barriers of entry to becoming a D2C are very low, one of the key reasons we’ve seen this sector become more crowded over the past few years. A fledging brand can set up an online store and begin selling using affordable dropshipping methods virtually overnight. However, growing pains can kick in extremely quickly if your business isn’t orientated towards rapid growth. In fact, Marketing Signals suggests the failure rate of these ecommerce businesses is as high as 90% after the first 120 days.

For example, self-fulfilling orders from home or the office work perfectly well when your order volumes are small. However, brands will inevitably have to switch to a purpose-build facility or partnering with a 3PL when your orders increase - and it’s difficult to predict when this is going to happen.

Consumer demand for a specific product can escalate with little warning, something we’ve seen happen a lot during the pandemic. If your brand isn’t able to deliver, this can result in valuable sales opportunities being lost.

But when you have the support of a larger partner who can shoulder some of this strain, this makes you much better positioned to leverage key growth opportunities.

There’s been a steady shift in recent years of D2C brands choosing to forgo online-only operations. D2C darlings from Casper Sleep and Warby Parker have embarked on aggressive store expansion strategies in 2021. The most recent is Glossier, which announced in June the reopening of its flagship stores after being shuttered for over a year due to the pandemic - in addition to three brand-new store locations.

Direct to consumer brands have long shunned physical retail due to the high overheads and the relative ease of building loyal customer bases online. So, what’s changed?

Many D2Cs have discovered the hard way that once you max out the number of people interested online, there’s nowhere else left to go. It’s no secret that even the most successful D2Cs have struggled to reach profitability due to rising customer acquisition costs. The COVID-19 pandemic and the greater diversity of consumers choosing to shop online has thrown digitally native brands a bone when they most needed it. But now that ecommerce growth forecasts are beginning to taper off, retailers will need to look elsewhere for customers.

However, most D2Cs aren’t in the position to begin opening multiple stores. Utilizing the existing store networks of partner retailers is a brilliant way to get your brand in front of fresh eyes - without having to shoulder the costs of running stores yourself.

Home fitness brand Tonal has been able to triple its physical presence by partnering with Nordstrom to put training stations inside 60 Nordstrom locations by the end of 2021. Consumers will be able to walk or book appointments to try out Tonal devices alongside representatives who can educate them about the brand.

Given the massive growth of interest in home fitness due to the pandemic, this partnership has been extremely well-timed and allows Tonal to piggyback on the rising success of Nordstrom, which is forecast to experience a 25% increase in sales in 2021.

By far the biggest advantage that D2C brands have over their retail distribution counterparts is that can they can maintain a granular level of control over the brand experience. Because they oversee the end-to-end marketing and branding strategies, they’ve achieved consistent and seamless interaction with customers. Furthermore, they’ve been able to accumulate valuable customer data to refine their value proposition and understand exactly what their customer wants.

However, partnering with outside retailers can mean losing this competitive edge. Notably, 55% of consumers say they would rather buy D2C than through an intermediary brand; because once your product is on the shelves or in the product catalog of another retailer, it’s much more difficult to exercise quality control over the customer experience.

For example, if your product is going to be on display inside a partner retailer’s storefront, you need to know exactly what the parameters of your brand’s visibility are going to be. Will you be allowed to use your own branded packaging, as opposed to that of the host retailer? Can you staff it with your brand representatives, or will you have to rely on existing staff who may know very little about your brand?

If the answer to these questions is no, your unique brand identity can easily end up being lost within a maze of offerings competing for attention. Moreover, loyal customers who are used to shopping with you online may find themselves experiencing very different service offline - and this isn’t going to do your brand any favors.

D2C fulfillment is fairly straightforward when you’re only having to coordinate one fulfillment workflow i.e., home delivery. But once you start adding retail fulfillment and wholesale into the mix, this requires a recalibration of your entire fulfillment strategy.

For example, if customers can opt to order products online and pick them up at a participating retailer, this requires seamless integration between your OMS and your partner’s inventory management system. If orders are going to be fulfilled in-store, your partner needs to have the manpower and space off the shop floor to do this effectively and avoid cannibalizing in-store sales, which may not be possible in every store location.

Furthermore, while major retailers give you access to a large source of customers, you have to be certain that you can meet demand. As peak season approaches, your brand needs to be ready to meet increased order volumes without undue delays. It may be necessary for your brand to partner with an experienced fulfillment provider who can coordinate a scalable fulfillment strategy responsive to shifts in demand.

In sum, D2C brands can both win and lose when going the route of acquisitions and retail partnerships. But we’re also seeing the development of a third option: D2C holding companies.

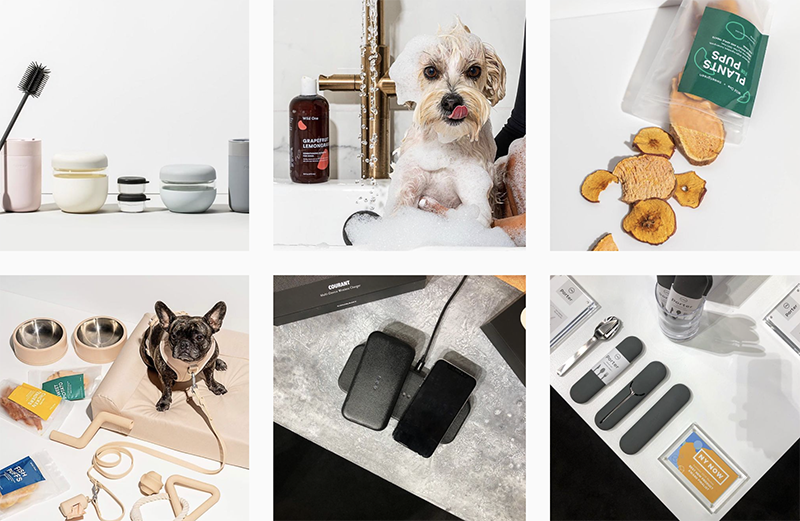

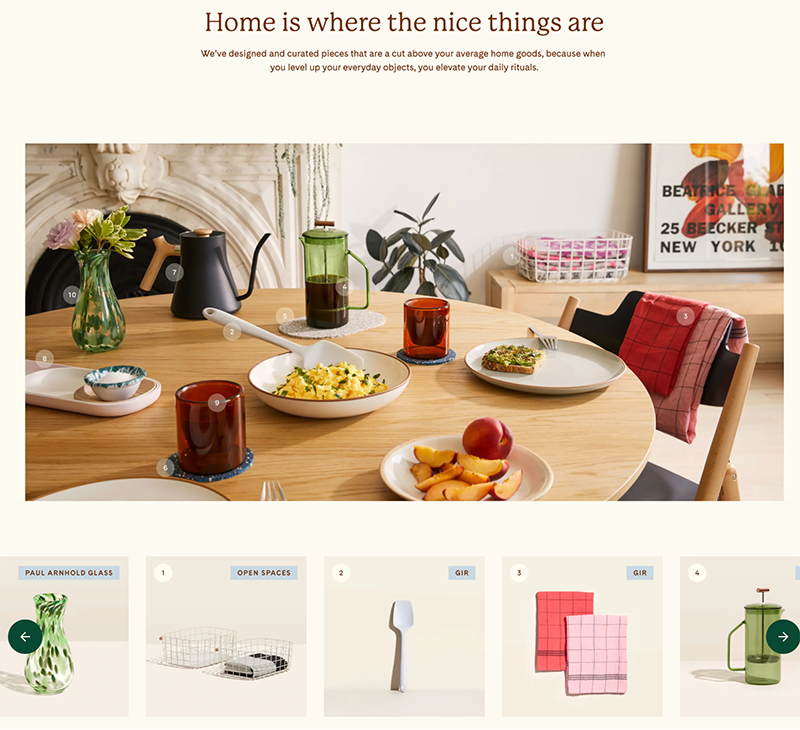

This refers to the growth of multiple D2C brands being hosted under one umbrella. These entities have either launched or acquired D2Cs within a specific product category, enabling them to corner customer demand much more effectively. Holding companies will typically run an online store where all their brands are featured alongside one another, which provides ample opportunity for cross-selling and product bundling initiatives.

The biggest advantage of D2C holding companies is that they offer brands centralized systems across customer care, logistics, and finance. This frees up valuable time and resources to focus on growth, branding, and product development, which can often be lost when brands are having to run the entire show themselves. By enabling D2Cs to scale effectively and reach their full potential without having to sacrifice control over their brand, holding companies are charting a value-added path forward that we’re likely to see a lot more of in the future.